dealing with loss

on recovering from drawdowns

2025 has been another incredible year of volatility, yet many people have still managed to lose money trading it.

This essay is not for people who have always been consistent losers, but for people who are otherwise profitable and competent, but still managed to give back a meaningful amount of money this quarter.

One of the greatest pains in life is watching months or years of work come undone all at once.

In Greek mythology, Sisyphus is condemned to spend eternity pushing a boulder up a hill, only to watch it roll back down the moment he reaches the top. There is something uniquely cruel about this punishment, something that cuts directly to the core of the human experience.

Trading has this same quality. Unlike most professions, there are no checkpoints. An entire career can be completely destroyed by one bad decision. It has driven many to suicide.

When the boulder does roll back down, people respond in two ways.

Some size up and try to win it back. They trade more aggressively and implicitly try to martingale the loss back. If they can make the money back quickly, they never have to emotionally confront what happened. This often works which is exactly why it is so dangerous as it reinforces a habit that is mathematically inevitable to leave you zero.

Others burn out and walk away entirely. These people often have enough money to live comfortably and the risks no longer feel asymmetric. They cope and tell themselves that there is no longer any edge in the markets or that they will no longer exist. They leave and effectively one shot themselves from markets forever.

Both responses are understandable but they are blunt instruments and neither address the real problem. The real problem is that there is a hole in your risk management system. Most people think their risk management is much better than it actually is.

Risk management itself is not an unsolved problem. The math is well understood. What makes it difficult is not knowing what to do, but actually doing it in spite of emotions, ego, pressure, and exhaustion. Aligning your actions with your intentions is one of the hardest parts of being human. Markets always ruthlessly expose these miscalibrations with reality.

So how do you get over the loss once it’s happened?

First, you have to accept that you were not unlucky. You were not treated unfairly. This loss was an inevitability created by a weakness in your process. If you don’t identify and fix the precise issue, it will happen again.

Second, you need to fully identify with your new net worth. You cannot anchor to your old all time high. The urge to “make it back” is one of the most dangerous impulses in markets. Step away from screens. Practice gratitude for how far you have already come. You are still alive. You are still in the game. You are not trying to make money back. You are simply trying to make money.

Treat the loss as tuition paid to the market for exposing a flaw. You were always going to learn this lesson. Be grateful you learned it now instead of later, when the stakes were even higher. You will look back on this moment with gratitude if you do the work correctly. Character is forged in hell.

Identify the failure precisely. For most people it is some combination of oversizing, entering without a predefined stop, or failing to respect the stop once hit. Having hard rules around risk and stops would prevent most catastrophic losses.

Remind yourself that the only way to prevent the boulder from rolling all the way back down again is to respect those rules. They are the only thing standing between you and the torment and self loathing you are currently experiencing. You are nothing without your rules.

Allow yourself to fully grieve the loss. Scream. Destroy something. Let the emotion out instead of having it live inside your body.

What matters most is that you channel the pain with precision. The trauma must be converted into structure. If it is not, it will repeat.

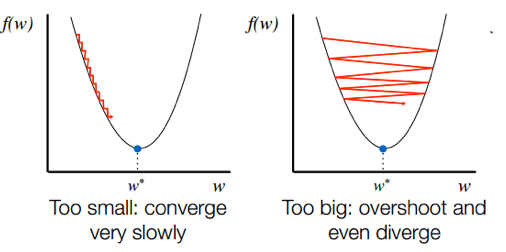

This realization about dealing with trauma applies not just to trading losses, but to loss in life more broadly. The impulses behind the common responses mentioned above are too blunt because they often introduce as many new externalities as they resolve. If you cannot recover from loss in a nuanced and precise way, you end up oscillating around the optimal solution indefinitely, unable to settle into the correct orientation like a gradient descent algorithm with too large large step size, forever overshooting convergence.

When Napoleon lost a battle, he immediately began rebuilding infrastructure and preparing his next move. A loss is only fatal if it compromises your ability to fight the next battle. The priority after defeat is to ensure that the vulnerability will not be exploited again and get back to your A-game as quickly as possible.

You do not seek redemption, you do not seek revenge. You don’t cope and you don’t seethe. You must be a fucking machine. You repair and rebuild. Prevent this mistake from happening ever again. Every defeat you survive becomes a moat in your system, one that everybody will all have to learn on their own terms.

Losses like this are what build a man. Be grateful for them. They happen to teach you something. The loss did not happen for no reason. Allow yourself to feel the pain but channel the torment into ensuring it never happens again.

These things are difficult because once you find the correct orientation, compounding to infinite wealth becomes inevitable.

Good luck.

What Thiccy is trying to say is be a Nondeterministic Finite Automaton

Damn with the title and thumbnail of this article I thought you were going to write about personal loss. Sadly when you have the life experience of true loss, these trading losses are nothing but paper cuts. At least in the case of sisyphus you get to try again, when you watch someone pass away that’s an irreparable loss that you will never recover from. What is a trading a loss or career set back in the grand scheme of real loss?