life lessons from trading

calibrating self to world

1) Traders get paid to guess where money will move.

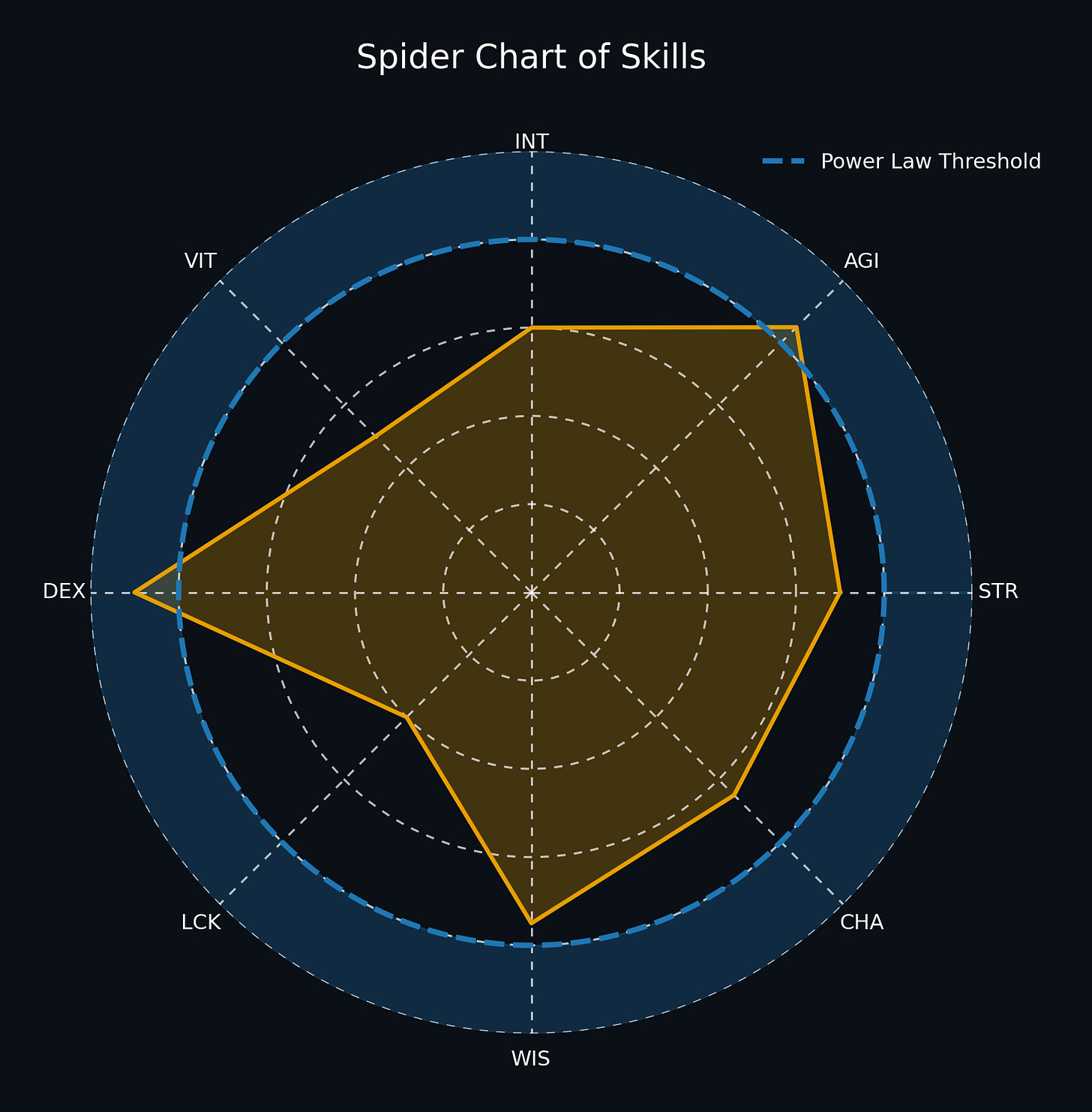

2) There are many ways people win guessing games:

Some people read new information quickly

Some people send guesses quickly

Some people process new information accurately

Some people recognize patterns quickly

Some people see patterns other’s don’t see

Some people read what other people are guessing accurately

Some have networks that gossip about what the money will do.

Some chase money where others cannot, will not, or do not know how to

3) Each of these skills is called an “edge”. You can think of each skill as a stat in an MMORPG.

4) The game is winner takes most. Fill out the circle and cross power law thresholds if you want to make money consistently.

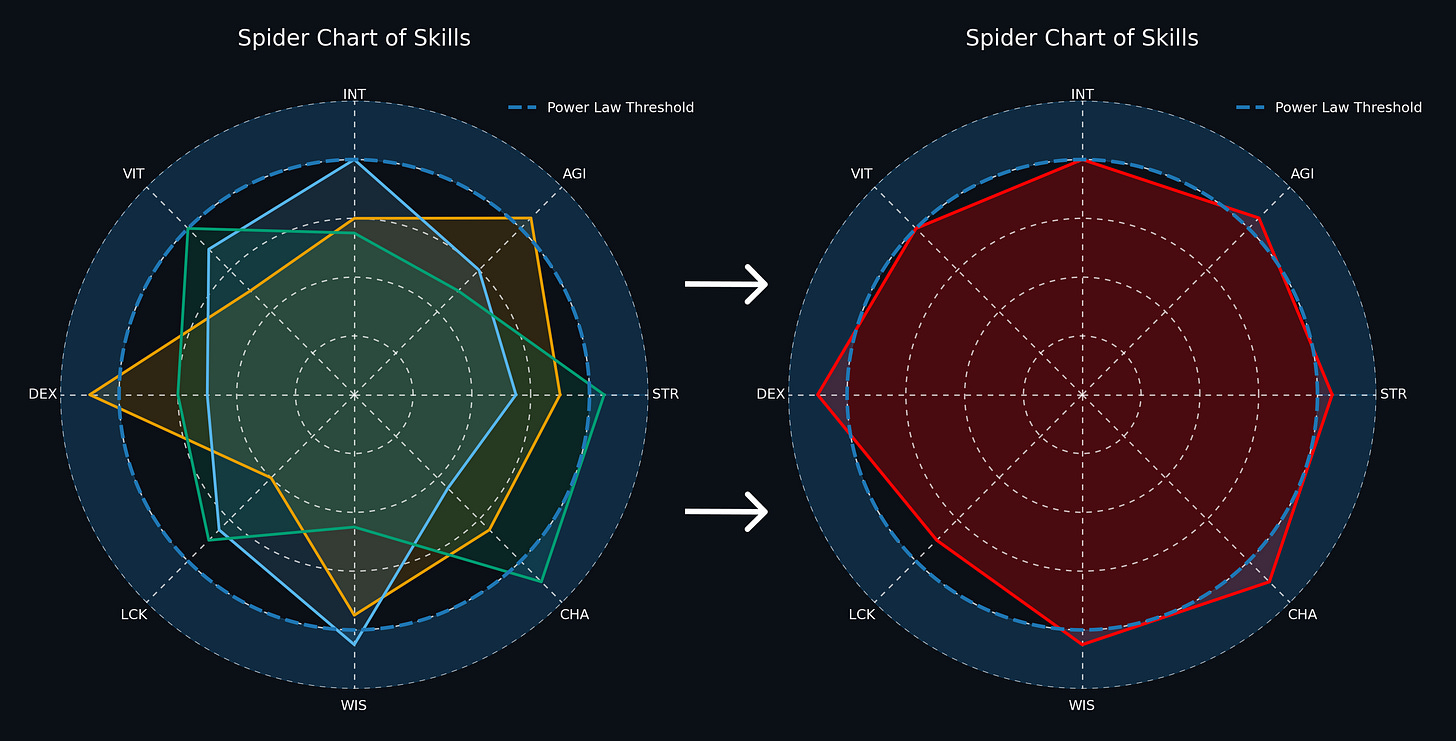

5) It’s easier to hunt as a team. Stacking everybody’s best skills clears more thresholds. Good trading teams are positive sum. The whole is greater than the sum of its parts.

6) Trust is built through iterated trust falls that grow in size. It’s important to calibrate the size of the trust falls well. Too large gets you rugged, too small keeps a relationship from compounding. Generosity goes a long way. Most people here are lonely, so making it fun is a valuable skill.

7) You have to be willing to sacrifice everything if you want to win. Most people don’t actually don’t want it badly enough and that is fine.

8) Play only the games you can learn to win again and again. Calibrate honestly about your abilities and where your competence actually sits in the world. Becoming world class in any game takes intense dedication, courage, and rare talents often shaped from childhood. The most important search is for the game that fits your specific strengths. Playing a game that wasn’t meant for you is a common tragedy in this industry. Trading has chewed up and spat out millions, wasting their best years and scattering their stories into the wind.

9) The guessing game always gets harder over time because it is an adaptive and darwinistic system. People learn, knowledge spreads, edges decay, winners grow, losers die.

10) Adverse selection is everywhere. Always ask yourself why someone smarter, better connected, or faster than you did not take the opportunity before you.

11) Most market participants are flipping coins with each other. Every so often someone will flip twenty heads in a row and look like a genius and spawns cargo cults.

12) Your best trades work out quickly and ferociously.

13) Trading exposes your deepest insecurities about yourself and the world. It is a fast way to learn what reality is and where you fit in it. In a way, everyone is a trader. We make calculated decisions with incomplete knowledge, manage drawdowns to avoid ruin, and turn our natural edges into returns. Almost everything comes down to calibrating your understanding of yourself with your understanding of the world. Many people underestimate their strongest unique traits and take too little risk in building a life around them.

14) Envy is the strongest emotion of the internet era. Handled well, it lets you copy what works from the best very quickly. Handled poorly, it turns creates scarcity driven anxiety and burnout.

15) The longer you trade you realize that you need to eventually find the need to build the foundation of your identity on something stable. An identity built on talent or contrarian views get challenged fast. Identities built on process are more sustainable, even if they trade off novelty and exhilaration.

16) Only the paranoid survive. Panic early. Always have an exit plan. Avoid deep drawdowns. Have humility and leave room for unknown unknowns. Be aware when you are selling tails. Stay liquid. Respect counterparty risk. Respect path dependence.

17) People often build artificial heavens around the goals they chase and artificial hells around the anxieties they run away from. This framing can fuel short bursts of motivation, but it is a unsustainable way to live for any length of time. Scarcity and anxiety distort decision making and leaves you prone to ideological capture.

18) Trading is a zero sum game inside a larger positive sum game. Though every trade has a winner and offsetting losers, markets as a whole direct resources across space and time and help civilizations grow. The emergent objective of complex systems is usually only visible in hindsight. If you get too cynical about the uselessness of what you do, you will spiritually one shot yourself and burn out.

19) The big picture is hard to observe clearly. You are an individual ant trying to make sense of the actions of the entire colony. Price and price action are lower dimensional shadows of a larger machine. Markets move for many reasons, but we carry reductive biases that flatten them into single neat stories.

20) Money changes a lot, but not everything. There are growing pains as you learn what truly shifts and what stays the same.

21) Profitable trading implies a local worldview that is more aligned with reality than that of the market’s dollar weighted average participant. But alignment in one market does not automatically translate into alignment in other markets. What carries over are the meta skills in recognizing and monetizing edges, understanding adverse selection, and measuring where the power law thresholds sit.

22) People in the trading industry tend to age terribly. Mental stress is costly. Put in intentional effort into taking care of yourself. Money means little without health.

23) Winning streaks often hide bad habits that come back to bite you over time. Losing streaks can make you question your entire process. Don’t get too high in the highs or too low in the lows.

24) The world is in a constant state of decay. Reality keeps shifting, and everyone’s models drift out of date and out of calibration. That is why there will always be room for the young, the hungry, and the obsessed to make money. People are like exponential moving averages of their lives. Short windows catch new trends first, even if some of what they catch is noise.

25) Markets train you to spot self reinforcing and self correcting loops everywhere you look.

26) Most outsized opportunity in modern markets ultimately stems from people trying to fill a void of meaning.

27) I am grateful that I get to play this game with my friends and get paid for it. Life is truly beautiful.

I’ll make a part two of this later. Thanks for reading :)

This is solid wisdom. The spider chart metaphor is particularly good - most retail investors I talk to don't even know what their edges are, let alone how to measure them against the power law threshold. Point 10 (adverse selection) is the most important one for my readers. When you're a retail investor and you see a "bargain," understand that the algorithm likely missed it, and the fund with 40 analysts and Bloomberg terminals passed on it. You are usually missing something.

Point 18 needs emphasis. Yes, trading is zero-sum. The house always takes a cut. Every trade, someone's skimming - the exchange, the market maker, the broker. It's a zero-sum game where the sum is actually negative for participants. The only way retail survives is by not playing the high-frequency game at all. Find your edge in patience, in research the algos don't care about, in timelines measured in years, not milliseconds. The game isn't fair. Knowing it isn't fair is itself an edge.

https://open.substack.com/pub/chaostrader913/p/the-zen-of-trading?utm_campaign=post-expanded-share&utm_medium=web