vibe trading

thin slicing and markets

Thin slicing is the ability to spot patterns and draw inferences from “thin slices” or narrow windows of experience.

It’s similar to that game you play as a kid where you are shown a few pixels of an image and you are supposed to guess what the image is. You are gradually shown more and more pixels until you guess the image, rewarding you with more points the faster you are.

Your mind naturally stockpiles heuristics that help you form quick judgements at a glance.

In the realm of social inference, snippets of body language such as subtle shifts in breathing, tiny facial expressions, and small variations in tone, are actually quite rich in signal and instantly form a “vibe” before you can even explain it in words. You give up some accuracy in favor of speed, but in many arenas being quick and reasonably correct beats being slow and perfectly calibrated.

Markets are one of those arenas where thin slicing dominates.

Markets act like the nervous system of civilization. Prices encode scattered local scarcities and surpluses into a single global number that channels societal resources to where they are needed most. They behave more like living and adaptive ecosystems than engineered machines, a collective intelligence probing for truth. Beautiful, misunderstood, and endlessly complex.

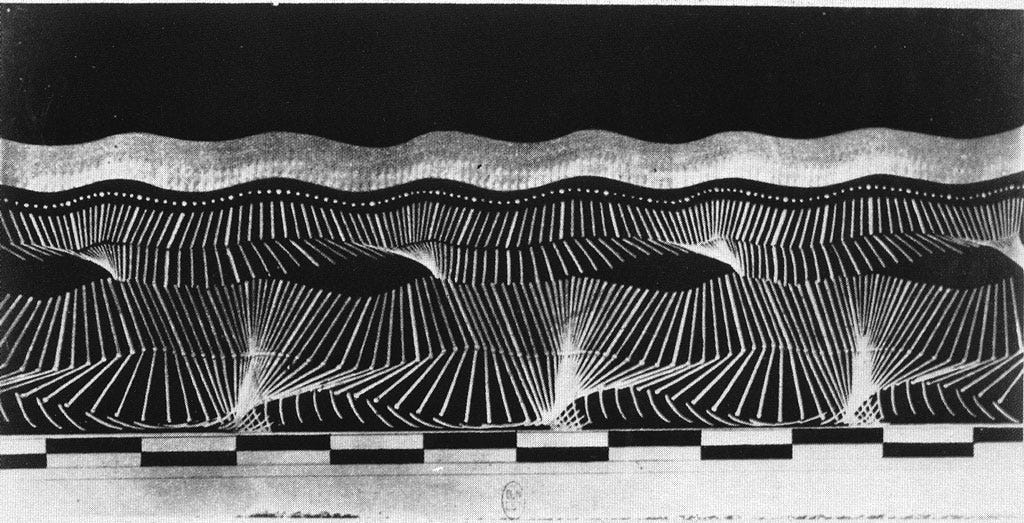

To the individual observer, the market resembles an incomplete mosaic, like the kid’s pixel-guessing game we mentioned earlier. Price action, order flow, sentiment, positioning. You glimpse only fragments of information and must infer the broader narrative of the market from those scattered clues.

Each participant watches different clusters of pixels light up. Tentative images overlap on the same canvas, some faint and others vivid. Edge comes from seeing pixels sooner, finding pixels others miss, ignoring pixels that do not matter, and, above all, guessing the emerging picture quicker and more accurately than everyone else. Connecting the dots and identifying the dominant “vibe” before the rest of the market earns you a handsome reward for pricing truth into the system.

Colm O’Shea puts it beautifully in his Market Wizards interview on macro trading:

Fundamentals are not about forecasting the weather for the next day, but rather noticing that it is raining currently.

It is hard enough to know what is, let alone what will be.

Racing to uncover what is is the essence of what it means to vibe trade.

And just as markets compress oceans of knowledge into the blunt value of a single price, vibe trading compresses millions of instinctive decisions into the equally blunt value of one PnL number. While the money is a nice testament to the value of knowledge you have priced into to the system, writing about the process is what truly captures the art.

> Markets act like the nervous system of civilization. Prices encode scattered local scarcities and surpluses into a single global number that channels societal resources to where they are needed most. They behave more like living and adaptive ecosystems than engineered machines, a collective intelligence probing for truth. Beautiful, misunderstood, and endlessly complex.

I think this is a great point that could be worth more posts. No one's defending the beauty of capitalism, invisible hand, price discovery these days

Please delete this alpha.