the fundamental value of bitcoin

measuring lindyness with attention time

Gold derives its value from some nice properties: it is scarce, fire resistant, immune to corrosion, and for millennia has served every major civilization as a store of value. Because of this long pedigree, people often describe gold as having “lindy” value, referring to the Lindy effect, which claims that expected remaining lifespan of an idea grows in proportion to the time it has already lasted. Simply put, the longer something has survived the longer we expect it to keep surviving.

Bitcoin, by contrast, has existed for only seventeen years since 2009, which seems trivial beside gold’s three thousand year record that dates back to the Lydian empire of Asia Minor in 700 BCE. For a long time I sided with the skeptics who dismissed bitcoin as digital fool’s gold, yet reframing the argument in terms of event based time rather than calendar time has softened my view.

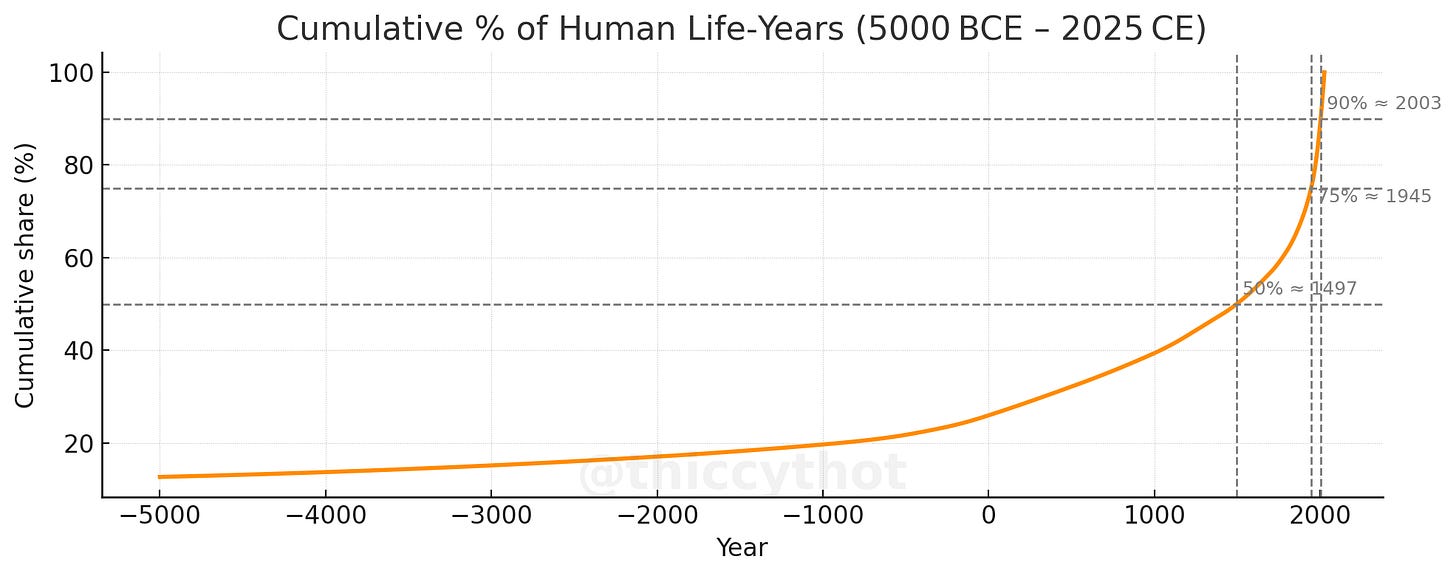

In a previous post I introduced the notion of a life-year, which is one person being alive for one year. Evaluating history by this measure explains why human progress has accelerated so sharply over the past two centuries as more exponentially more conscious minds have proliferated that each discover, innovate, and acquire new knowledge.

Since Bitcoin’s inception in 2009, ~130 billion life years have elapsed, an average population of 7.6B over 17 years.

Gold, judged from 700 BCE onward, has accumulated ~1.3 trillion life-years, meaning that roughly 81% of all human consciousness has lived in a world where gold is already established as money. 1

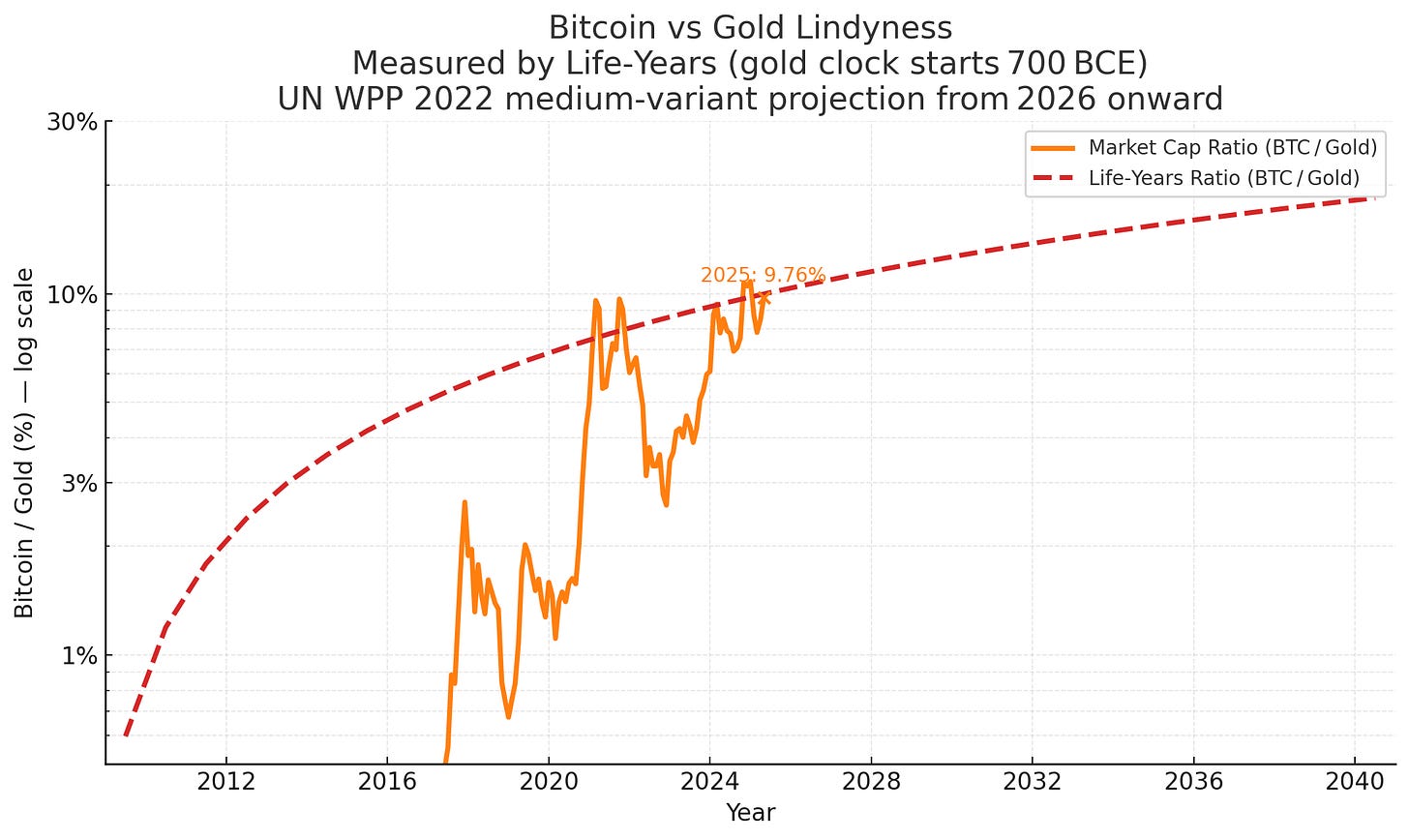

On a simple calendar scale bitcoin has existed for just 0.6% of gold’s lifespan, yet when we weight the years by the number of minds alive to evaluate each asset, bitcoin’s attention-time lifespan rises to about ten percent of gold’s lifespan. Because today’s world hosts far more observers than any earlier period, recent years carry greater informational weight, and in aggregate humanity has “experienced” bitcoin one tenth as much as it has experienced gold.

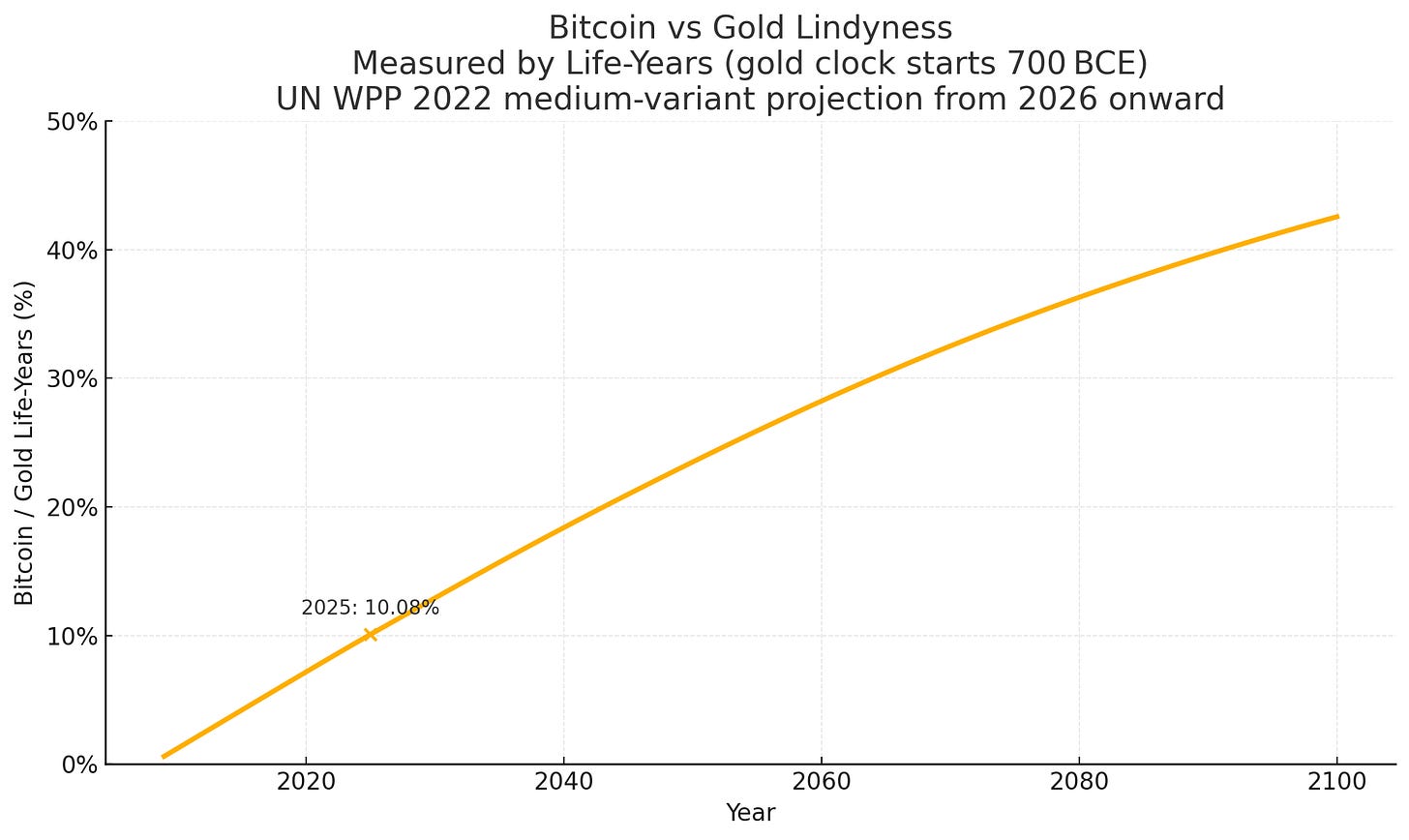

Coincidentally at the time of writing this article, the market cap of bitcoin is currently at 2.1T, almost exactly 10% of the market cap of gold at 21T. Projecting the same attention-time measure forward with UN population forecasts yields the following rough path for bitcoin’s fundamental value relative to gold.

12.8% of gold at 2030, translating to 135k BTC with gold at constant price.

15.7% of gold at 2035, translating to 164k BTC with gold at constant price.

18.4% of gold at 2040, translating to 191k BTC with gold at constant price.

That trajectory implies an average linear gain of about 5.5 percent per year, well below the roughly 12% annual carry cost of maintaining a long bitcoin short gold position through CME futures.

An attention-weighted Lindy framework feels like an appropriate and novel lens for examining bitcoin. We’ve gotten to a point that even a civilization level catastrophe like widespread nuclear EMPs would not erase every copy of the blockchain. With LLMs now able to compress all of human knowledge into weight files only a few hundred gigabytes large that is easily indexable, it would not be difficult to find the technical instructions to reconstitute the network. Humanity would likely rebuild digital infrastructure rather quickly and probably never come close to going back to the ways of the Lydian Empire of moving physical gold coins around.

Linear time obviously still matters and not every moment of human attention should count equally. We probably shouldn’t weigh a billion TikTok dance videos as heavily as World War II. Life-years are a blunt proxy for collective reasoning capacity, not an assessment that every event carries the same historical importance.

But as a first pass metric, it seems useful for evaluating bitcoin’s lindyness. I’m definitely more open to its relative valuation now having thought through things with this perspective. Let me know what you think.

data+code to generate all plots are located here: https://github.com/alexjchen00/lifeyears

bitcoin was not an established financial asset till arguably 2021, and between 2009 and 2017 very few knew about its existence other than having heard about it a couple of times as a weird internet experiment. therefore giving full weight to those years does not seem a sensible assumption

It’s interesting because while “recent years carry more informational weight” as you say, the the capacity for people to keep that information top of mind has not scaled proportionally to the massive increase in information quantity. So it might be a case of lindy+ or boosted lindyness of something can manage to stay on top in a world of tiktok lifespans